[ad_1]

Mexico’s CFE International LLC (CFEi) reported a 7% year/year increase in natural gas sales transactions during the first quarter, according to NGI’s Top North American Natural Gas Marketers ranking.

CFEi, a fuel procurement and marketing arm of state-owned power utility Comisión Federal de Electricidad (CFE), transacted 3.54 Bcf/d of gas in the first quarter, up from 3.31 Bcf/d in the same quarter last year. That made it the continent’s 13th largest marketer by volume, according to the survey.

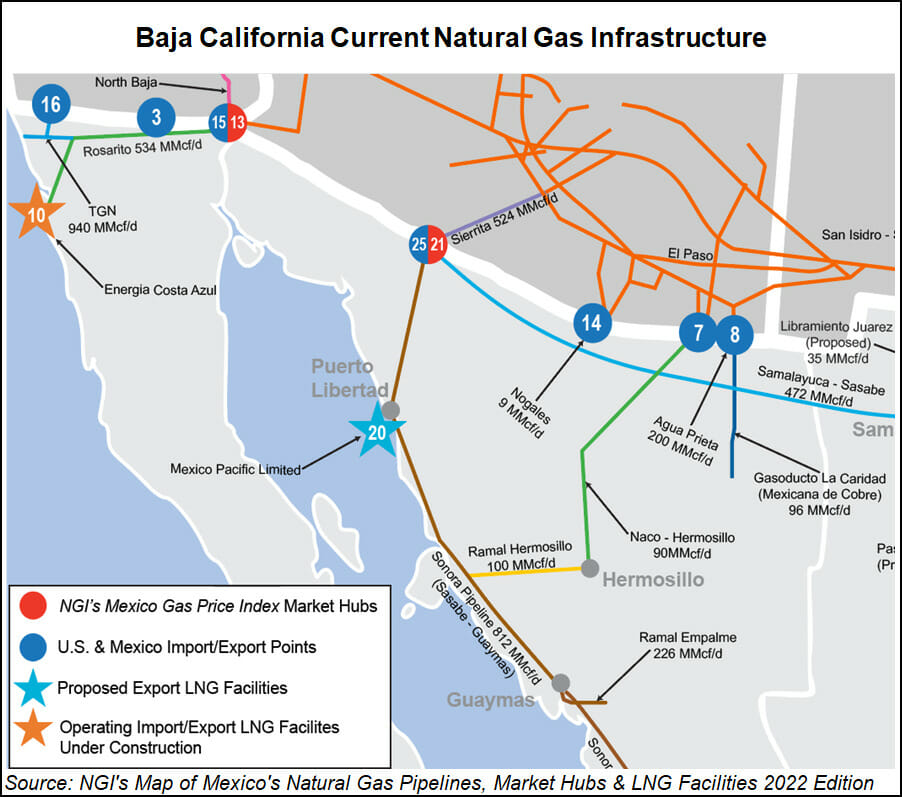

CFE has sought to continue expanding its natural gas import capacity from the United States in order to supply its gas-fired power plants and grow its domestic gas marketing business through subsidiary CFEnergía.

A proposed amendment to the terms and conditions on the Sistrangas pipeline network could also mean a much larger role for CFE in the gas market.

U.S.-to-Mexico exports of natural gas by pipeline averaged 5.9 Bcf/d in 2021, up from 5.45 Bcf/d in 2020, according to the U.S. Energy Information Administration (EIA). Pipeline flows to Mexico (excluding non-public intrastate flows) have hovered around 6 Bcf/d this month, according to NGI data.

Sales Up Across North America

Top North American natural gas marketers collectively boosted sales volumes in 1Q2022, gaining ground amid robust domestic activity and an acceleration of global demand for exports of liquefied natural gas (LNG), according to NGI’s quarterly tally.

The 24 companies included in the latest NGI Top North American Natural Gas Marketers rankings reported combined sales transactions of 125.62 Bcf/d for the first quarter, up 1% from 124.31 Bcf/d in 1Q2021.

Steady late-winter heating demand in the United States and Canada intersected with intensifying calls for American LNG during the quarter. Asia and Europe, already low on gas in storage, lifted demand for U.S. exports to record levels during the winter.

Then in late February, Russia invaded Ukraine, and countries across Europe galvanized to wean themselves off Kremlin-backed gas in opposition to the conflict. They have since looked for U.S. exports to help fill the void, punctuating a robust demand profile that many traders and marketers are confident will persist through 2022 and beyond.

[Get in the know. Access to pipelines, processing plants and LNG facilities is imperative to success in the Mexico natural gas market. Buy NGI’s 2022 Mexico map today.]

“Internationally, there is simply more demand than supply right now,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI. “So that’s going to keep LNG exporters sending out as much as they can.”

U.S. production reached a high around 97 Bcf during the past winter – near a peak level since the onset of pandemic — to meet the demand, providing marketers the wherewithal to drive up volumes in the first quarter.

Several marketers, including perennial top 10 companies ConocoPhillips and EQT Corp., reported robust gains in the quarter alongside the bullish developments early in the year. They expect momentum to endure. ConocoPhillips reported 1Q2022 volumes up 10% year/year and EQT posted a 19% gain.

Other big gainers were Southwestern Energy Corp. (up 76%), EDF Trading NA (12%) and Coterra Energy Inc. (24%). Coterra formed last October as a result of the merger of Cabot Oil & Gas Corp. with Cimarex Energy Co.

ConocoPhillips CEO Ryan Lance is bullish on the U.S. market and, increasingly, global opportunities.

“We’re pretty big fans of LNG,” Lance said on the first quarter earnings call in May. “We think the Asian market and the European market, obviously as a result of this invasion of Ukraine, has bolstered” the long-term bull case for international demand.

EQT CEO Toby Rice said the war amplified the necessity of natural gas to both meet global energy needs and support a long-term transition toward zero emissions to blunt climate change. He said the surge in LNG demand this year shows that countries around the world need gas, as a cleaner alternative to coal and other sources, to meet their energy needs.

“The influx of support from the broader public has also been tremendous and will ultimately empower our industry to meet the energy demands of Americans while providing energy security to the world,” Rice said on the recent earnings call.

The strong demand, he added, “is likely structural in nature.”

Building For The Future

Investments in new infrastructure are needed, Rice said, and both EQT and the broader industry are amassing political support to expand. Rice said this is critical.

Indeed, after peaking in the winter, production during the spring months proved choppy amid annual spring maintenance projects. Output has wavered between 92 Bcf and 96 Bcf much of the season. While EIA expects U.S. dry natural gas production to rise from an average of 95.7 Bcf/d this month to 97.9 Bcf/d for the second half of 2022, market participants said the increase is paramount to ensure a balanced market ahead of next winter.

Imbalance concerns have fueled price spikes this year. U.S. natural gas futures in May reached the highest level in 14 years – and did so again this month – because of intensifying global competition for American supplies. Futures have recently traded well above $9.00/MMBtu.

EIA reported a 97 Bcf injection into Lower 48 storage for the week ended June 3. The build lifted stocks to 1,999 Bcf. Still, gas in storage remained 14.5% below the five-year average heading into the peak cooling demand season.

To be sure, an explosion last week at the Freeport LNG export terminal left market participants contemplating potential demand destruction through 2022 that could provide storage a boost. With feed gas otherwise destined for the export market staying in the United States, domestic gas prices fell this week. But the single setback to exports does not alter the larger demand picture.

“Pretty much everyone agrees we almost have to produce more,” U.S. Global Investors’ Mike Matousek, head trader, told NGI. “But the market needs to see it happen.”

For 2023, EIA expects domestic production to grow to 101.6 Bcf/d on average.

Domestic consumption, meanwhile, is on pace to average 85.3 Bcf/d for 2022 as a whole, a 3% increase over 2021 levels, EIA said. The agency expects it to hold at that level next year. U.S. exports, meanwhile, regularly reached the maximum that American facilities can support – just above 14 Bcf in feed gas.

The data illustrate the need for greater output, StoneX’s Saal said. Should production rise to the challenge, it could pave a path for gas marketers to mount further momentum as 2022 wears on.

“We do need the higher production to come through this summer,” Saal said.

‘Hyper-Focused’ On Gas

Overall, one-half of the 24 marketers that make up NGI’s ranking posted gains in volumes during the first quarter.

Williams Cos., a new entrant at No. 7, was among them. It reported a 1% advance. Williams acquired former top 10 marketer Sequent Energy Management in 2021.

Williams CEO Alan Armstrong, speaking at a conference in May, echoed colleagues’ sentiments, saying global demand will prove durable and production must increase to meet it.

“We are not keeping up with the growth in demand,” Armstrong said, though he looks for the industry to catch up. Should that happen, it would moderate prices to profitable but affordable levels and create an abiding bull case for natural gas demand, he said.

Should EIA’s production outlook prove accurate, Henry Hub natural gas spot prices will average $8.69/MMBtu in the third quarter but retreat to $4.74 in 2023.

“We think natural gas is going to have a huge future because it’s low cost and it’s low emissions,” Armstrong said. “If we can’t keep the prices low and can’t get the infrastructure in place to be able to access it, we are going to damage some of the markets” such as Europe. But he thinks the industry can rise to the challenge.

“We are very hyper-focused on natural gas.”

Christopher Lenton contributed reporting

[ad_2]

Source link