[ad_1]

The value of cross-border energy trade between the United States and Mexico reached a nine-year high of $42 billion in 2021, according to the U.S. Energy Information Administration (EIA).

The figure is the highest ever recorded in U.S. Census Bureau data, which started in 1996, said EIA researchers led by Natalie Kempkey.

The immense flow of energy between the North American neighbors consists mainly of petroleum products and natural gas from the United States to Mexico, and crude oil from Mexico to the United States.

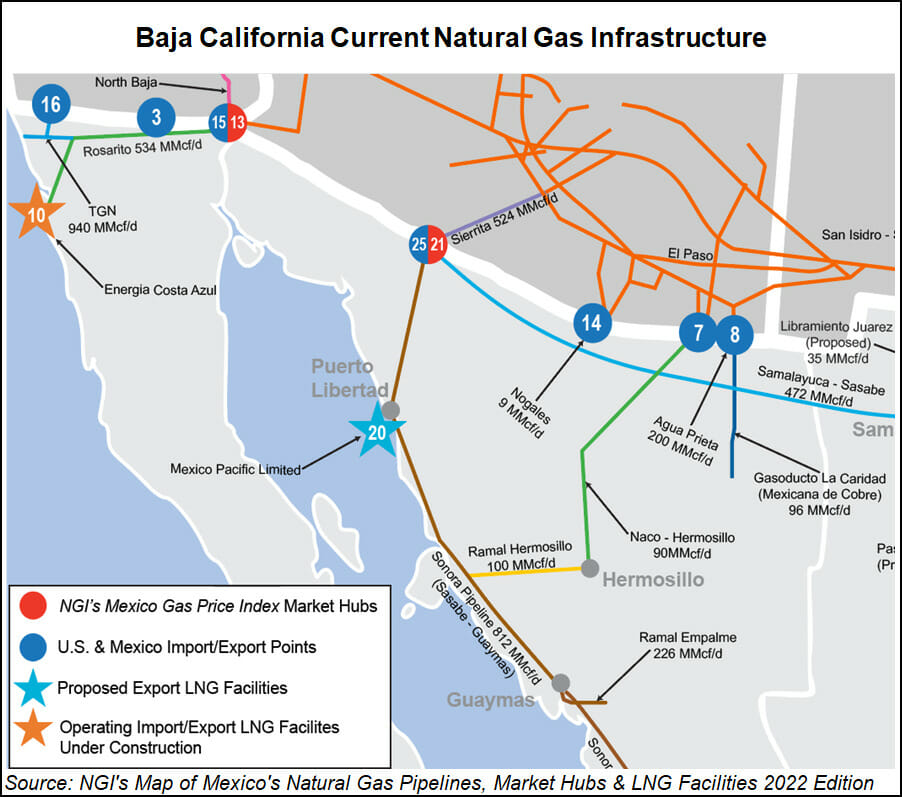

U.S. natural gas exports to Mexico averaged 5.9 Bcf/d in 2021, of which 99% was sent by pipeline, researchers said. This is up from 5.45 Bcf/d in 2020.

Petroleum products, including finished motor gasoline and distillate fuel oil, are “the largest component of energy trade with Mexico on a value basis,” the EIA team said. Exports of U.S. petroleum products to Mexico increased from a low of $19 billion in 2020 to $31 billion in 2021.

“Use of petroleum products in Mexico increased in 2021 as the economy recovered from the Covid-19 pandemic,” researchers said, noting that more than half of Mexico’s total gasoline demand was met by the United States.

Meanwhile, Mexico supplied 583,000 b/d of crude oil to the United States in 2021, making Mexico the second-leading supplier of U.S. oil imports behind Canada. “Even though by volume this amount is a decrease compared with 2020, the value of U.S. crude oil imports from Mexico rose to $13 billion in 2021, consistent with global oil price increases,” researchers said.

Cross-border natural gas prices in North America, meanwhile, jumped in 2021 but stopped short of regaining peak annual averages reached in 2005 and 2008, according to the latest annual international trade scorecard compiled by the U.S. Department of Energy.

Prices of U.S. pipeline shipments to Mexico in 2021 averaged 167% higher year/year at a price of $5.41/MMBtu. U.S. liquefied natural gas (LNG) cargoes scored a 2021 increase of 68% to $7.34.

Canadian exports to the United States fetched a price of $3.64 in 2021, up 87% year/year. U.S. sales to Canada climbed almost as fast, rising by 78.6% to $3.79.

The full-year 2021 international trade price averages stayed below the $10.00 mark for gas trade in 2005 and 2008, before hydraulic fracturing flooded North American markets with shale gas.

International gas trade volumes also increased last year, show records compiled by the DOE’s Regulation, Analysis and Engagement office. U.S. LNG shipments reached 40 countries, jumping by 36% to 3.5 Tcf or 9.8 Bcf/d.

[Tune In: Gain a unique perspective of South America’s natural gas and LNG market, fundamentals and pricing by listening to NGI’s Hub & Flow podcast: What is South America’s Natural Gas Outlook Amid Today’s Tight Global Energy Market?]

The 2021 top three overseas destinations for U.S. LNG accounted for 1.26 Tcf or 35% of the cargo total of 3.5 Tcf. This included 454 Bcf shipped to South Korea, 450 Bcf to China and 355 Bcf to Japan, DOE data showed.

The top customers also ranked high in the LNG price range of $5.45-$10.39, with 2021 tanker cargos averaging $7.18 in South Korea, $7.23 in China and $7.51 in Japan. Only small volumes, shipped in freighter containers, fetched prices at $10 or more.

Canadian deliveries to the United States grew by 2.5% to 2.9 Tcf in 2021. U.S. flows to Canada increased by 3.7% to 937 Bcf, while flows to Mexico rose by 52% to 2.2 Tcf.

Gordon Jaremko contributed to this story.

[ad_2]

Source link