[ad_1]

All questions

Year in review

i The insurance sector

In 2021 the Mexican insurance market began to recover from the contraction of 2.9 per cent caused by the pandemic in 2020. By September 2021 the insurance market grew around 5.3 per cent, according to the figures of the CNSF, with a raising of direct premium to 494 billion Mexican pesos, a figure that exceeds the one for 2019.

However, the loss ratio increased by 11.9 per cent by the end of September 2021, with an increase of 14.2 per cent in life insurance and of 20.4 per cent in health insurance; the highest increase since the implementation of Solvency II.

The life and health insurance markets have grown as a result of the pandemic, despite an increase in the cost of premiums partly because of the inflation in private healthcare services. Despite the growth of life and health insurance, the proportion of the Mexican population insured is still very small; according to AMIS’ figures, only around 15 per cent of Mexicans in a formal job have a life insurance.

On the other hand, the drop in travel insurance and coverage for tourist destinations such as Quintana Roo was noticeable early in the year as a result of the pandemic. Automobile insurance was one of the lines of business most affected by the pandemic with a decrease in premium of 2.4 per cent by the end of September 2021 mainly because of the substantial contraction in car sales.

According to the CNSF, as of February 2021, the Mexican insurance sector comprises 101 insurance companies licensed to operate in Mexico (of which 56 are subsidiaries of foreign insurance companies) and 241 foreign reinsurance companies registered with the Reinsurance Registry, including Lloyd’s of London. Nine atomic pools (nuclear insurance pools) were also registered with the Reinsurance Registry to take reinsurance in Mexico. Direct premiums in the insurance and surety sectors decreased had by 4.6 per cent by the end of September 2020 compared to the same period in 2019. Of the total amount of premiums by the end of September 2020, 97.7 per cent came from direct insurance and only 2.3 per cent came from reinsurance.

The penetration of insurance with respect to Mexico’s gross domestic product is 2.3 per cent. In 2020, AMIS and the CNSF announced that they will work together on a strategy to increase penetration to 2.8 per cent by 2022, but no further information has been released on the progress of this strategy.

In the context of the 30th annual convention of AMIS, the CNSF, the SHCP and AMIS entered into a memorandum of understanding with the purpose of promoting gender equality, diversity and inclusion in the insurance sector.

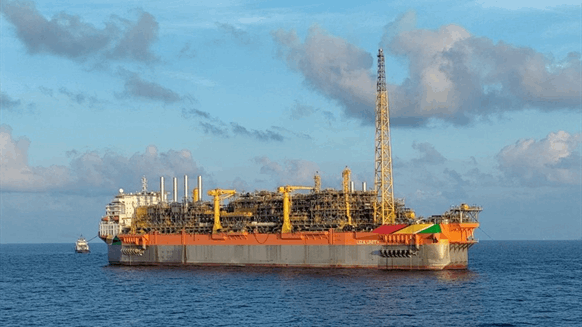

For the fourth consecutive time, Mapfre won the public tender to placement of the two-year property and casualty (P&C) policy for Pemex, which represents a total premium of US$563 million.

ii Lloyd’s

Probitas 1492 (syndicate 1492), Newline Group (syndicate 1218) and Liberty Mutual Re (syndicate 4472) Specialty Services are the only three Lloyd’s syndicates with physical presence in Mexico. The lack of appetite of Lloyd’s for Latin-American risk continues shifting to other regions and products and in its strategy. It is still unclear how this will affect the business flow and capacity that was traditionally provided to the Mexican market by Lloyd’s.

Two Mexican groups, Grupo Nacional Provincial and Reaseguradora Patria currently have investments in Lloyd’s.

iii Regulators

The CNSF has made progress adjusting to the administration of President López Obrador and, albeit during a pandemic, it is now operating more efficiently. Moreover, the technological tools and procedures that were implemented as a result of the pandemic are now fully in place and the market has become accustomed to them.

Ricardo Ernesto Ochoa Rodríguez continues to serve as president of the CNSF.

The temporary scheme established on 3 August 2020 by the CNSF regarding the procedure for the calculation of terms based on the level of contingency of the covid-19 pandemic (determined by the federal government) is still in place.

Carlos Noriega, who served as head of the Insurance, Pensions and Social Security Unit in the Ministry of Finance since March 2020, resigned from the position on 1 January 2021, being replaced by José Alfredo Tijerina and subsequently by Héctor Santana Suárez, who currently holds the position.

Outlook and conclusions

i Regulatory

The CNSF and the SHCP have been clear on their concern about the low penetration of insurance and their commitment to take action for a more inclusive market; however, no relevant actions have been implemented to this end.

With regard to catastrophic risk, the General Law for Comprehensive Disaster Risk Management and Civil Protection, expected to be approved in 2021, has not yet been approved by the Senate. Currently, the federal government has a catastrophic insurance for up to 5 billion Mexican pesos with a franchise of 275 million Mexican pesos. It also has a CAT-Bond for US$485 million for earthquakes and hurricanes valid until March 2024. However, these instruments are not sufficient to cover the funds of the natural disaster fund FONDEN. After the cancellation of the natural disaster fund FONDEN back in September 2020, the lack of sufficient resources and a reliable mechanism to cover catastrophic risks should be a matter of concern.

There has been an increase in demand for political risk coverage, given the growing perception of the potential for damage to investors and companies as a result of political decisions by the current government, mainly in the infrastructure and the energy sectors.

While the regulators are aware of insurtech’s potential to provide access to the benefits of insurance products for vulnerable groups, the present regulatory regime has unfortunately become a hurdle rather than an incentive for the development of products and projects in this area. Coping with compliance and regulatory challenges, including a strict anti-money laundering (AML) regime, data protection and privacy regulations, makes it difficult for start-ups to flourish in this highly regulated industry. Notwithstanding this, new risks continue to require innovative products, presenting new challenges to the regulators. Although the country’s industry is solid and well-capitalised, it nonetheless continues to disappoint in terms of penetration, inclusion and innovation.

We have seen a growth in funds’ appetite for working with insurance companies and benefiting from them as institutional investors. The insurance industry has not fully embraced its potential as a key institutional investor, with the exception of a few insurance companies actively investing in private equity, venture capital and other securities, such as development trusts and real estate trusts. There is interest in seeing regulators enhance and provide incentives to insurance companies and we still expect to see changes in insurance companies’ investment programmes, in line with the current government’s interest in financing long-term infrastructure projects.

ii Case law

We continue to see a growth in insurance and reinsurance-related disputes and related litigation, resulting in the development of court precedents on insurance and reinsurance related matters. The courts are very active in developing the concept of moral damages (similar to that of punitive damages); the concept now forms part of most claims, with important consequences for the insurance industry.

The contra proferentem principle in insurance continues to be applied, affecting insurance claims that are being argued before the courts.

The Mexican Supreme Court (SCJN) ruled in favour of the possibility to claim on constitutional grounds through an amparo lawsuit if an insurance company refuses to give coverage on medical expenses to people with Down’s syndrome or other disabilities based on that disability. This was a relevant precedent to protect human rights.

On 17 February 2021, the First Chamber of the SCJN issued a judicial precedent pursuant to which it determined that if a premium is not paid within the grace period of 30 days from the perfection of the contract or as agreed by the parties, the insurance contract terminates automatically, even if the insurer received the premium.

The rationale of SCJN is based on the assumption that the insurance contract is bilateral, onerous and aleatory, and is perfected at the moment in which the contracting party becomes aware of the acceptance of the offer made by the insurer. Additionally, according to the LCS, from the due date for payment of the premium, the contracting party has a grace period of 30 calendar days to pay the premium. If the contracting party pays the premium after said term and the insurer accepts the late payment, the effects of the insurance contract may not be rehabilitated. According to the criteria of the SCJN, once the insurance contract is terminated, there must be a new offer from the insured and the same shall be agreed with the insurer to formalise a new insurance contract.

Moreover, the SCJN issued a second precedent stating that pursuant to Article 41 of the Law the insurance contract is invalidated when payment of the insurance premium is made outside the grace period of 30 calendar days, even when the insurer does not immediately refuse such payment. In this case, the rationale of the First Chamber of the SCJN, consistent with the judicial precedent described above, is based on the premise that the first paragraph of Article 40 of the Law establishes that if the contracting party does not pay the premium or the corresponding instalment (in the case where it is paid in instalments) within the grace period of 30 calendar days, the effects of the insurance contract will cease automatically at 12 o´clock on the last day of such term.

iii Reinsurance claims

As previously identified, one of the main sources of disputes in reinsurance stems from fronting arrangements widely used in Mexico in the context of a legal framework where the insurance company maintains its liability to the insured despite the fact that, technically, it is simply fronting the risk. This particular state of affairs – where reinsurers’ lack of understanding of Mexican law and the lack of diligence in policy underwriting to ensure wording considers the effects of Mexican law with regard to English wording of reinsurance placements used in fronting arrangements – has consistently raised discrepancies between insurance and reinsurance policies and Mexican law, and is the origin of a number of disputes between the London and Mexican markets.

These inconsistencies are further exacerbated by abusive practices in the handling of claims by the reinsurance market, prejudicing the insurance companies that placed the business through fronting arrangements.

We have seen some interesting developments in the Mexican AML regime aligned with international standards and these may contribute to harmonising local placements with limitations of liability under international reinsurance programmes.

There is opportunity in Mexico to use effectively and promote alternative dispute resolution mechanisms specialised in insurance and reinsurance claims, including mediation and arbitration and the use of ARIAS Mexico. The inclusion of arbitration clauses in insurance and reinsurance agreements provides for the resolution of conflicts arising in reinsurance contracts through arbitration and also serves to prevent certain situations arising in global insurance programmes. However, the reinsurance market is still generally reluctant to include mediation and arbitration clauses in reinsurance policies.

In November 2019, the Principles of Reinsurance Contract Law (PRICL) were published by the Project Group (a joint venture set up by several universities and professors, primary insurance company representatives, reinsurance companies and reinsurance brokers and special advisers) in cooperation with the International Institute for the Unification of Private Law (known as UNIDROIT). The PRICL set specific reinsurance rules applicable to contract law, with a view to providing help in areas where reinsurance practitioners felt the need to improve legal certainty. The PRICL have been drafted as soft law, which means they will work as optional guidelines on reinsurance contract law when chosen by the parties, and for these principles to have binding effect, the contracting parties should choose to adopt them voluntarily. However, there is also the possibility that the PRICL may be applied by courts or arbitral tribunals, as the case may be, even in cases where the parties have not chosen to apply them.

The covid-19 pandemic has also raised conflicting views regarding life reinsurance coverage, with arbitration proceedings under way to resolve disputes between Mexican cedents and foreign reinsurers in relation to coverage during the pandemic.

Disputes between cedents and reinsurers regarding reinsurance coverage of losses caused by the pandemic are still continuing, mainly concerning life insurance. Most of such cases are subject to arbitration, therefore the awards will be confidential.

iv Distribution

There have been no changes and the distribution channels in Mexico continue to be strictly regulated and extremely limited, resulting in a lack of penetration of insurance within small and medium-sized companies, which contributed around 52 per cent of the national gross domestic product during 2019.

Bancassurance is one of the most important areas of growth within the industry. With very few exceptions, most banking groups operating in Mexico have transferred their insurance business and operations to insurance groups and entered into exclusive distribution arrangements.

Although there has been an increase in distribution through online platforms, the traditional distribution through brokers covers 59 per cent of the premiums.

v Consolidation

We have seen an active insurance market with various M&A transactions and joint ventures. We expect to see further consolidation or growth, or a combination of these, among the current market participants in Mexico in both insurance companies and intermediaries. In particular, we expect health insurance to be a key driver of growth in the insurance industry in the years to come.

We have also seen a number of joint ventures between the main insurers and insurtech start-ups and technology companies for boosting their capability to provide new digital client-focused products.

vi Product development

The interest in parametric insurance products for catastrophic risks keeps growing, and there is extensive activity regarding developing and placing parametric insurance products in the insurance and reinsurance market in Mexico. We also expect to see an increase in the distribution of parametric insurance products for individuals.

The healthcare insurance business has been one of the main areas to see a growth trend in the past year, with new participants entering the market and the introduction of innovative products. The fact that Mexico has a vast population without medical insurance and which is unable or unwilling to purchase traditional healthcare insurance means the country is an attractive prospect for investors and for launching new products. New products in the area of telemedicine and those with a preventive approach have been successfully placed in the market, and we see continuing interest from various participants in growing their stake in the healthcare insurance business.

Cyber insurance continues growing as the risk of hacking and the concern of companies for data protection increases.

Since January 2019 all vehicles circulating in federal roads and motorways must have a liability insurance; however, the federal government has not been able to enforce compulsory motor insurance. According to the financial products ombudsman CONDUSEF, seven out of 10 drivers are not insured.

There has been an increase in the premiums for providing professional liability coverage that does not reflect conditions in the Mexican market. This adjustment is, in fact, a result of international market conditions and it is evident from this that there is a lack of good underwriting practices for products of this kind being placed in Mexico.

In 2021, Mexico was the second largest target for fintech investments in Latin America as insurtech start-ups keep penetrating the market. According to Asociación Insurtech México (AIM), in 2021 there were 43 insurtech companies already operating in Mexico. Most of the insurtech business is in life and health, and auto and mobility lines, and around half of them are focused on marketing and distribution according to the Radar InsurTech Report 2021.

[ad_2]

Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ARHZ5EW6L5LVVIRTRRXQNLFDWA.jpg)