[ad_1]

diegograndi/iStock via Getty Images

The Wall Street Journal ran an article Friday titled “Mexican Factories Gain in Supply-Chain Revamps.”

The article begins as follows:

New data suggests Mexican suppliers are gaining ground as manufacturers reset their supply chains amid growing global disruptions.

Last year, large American manufacturers solicited chemicals, produce and construction materials and other goods from six times as many suppliers based in Mexico as they did in 2020, according to procurement software firm Jaggaer.

Jaggaer collected data for large American manufacturing firms that do billions of dollars a year in revenues. It found an unprecedented boom in orders from Mexican suppliers, meanwhile, the amount of Chinese suppliers used in business actually declined outright.

This is slightly complicated data, so let’s unpack it a bit. What Jaggaer is tracking is the number of different suppliers that a company uses in its supply chain. Say you’re making truck engines in Texas. How many different bolt makers do you rely on for that factory? In the past, the answer often was one, and it’d be one from China. Now, the answer is increasingly three or four, and they’re from Mexico.

Jaggaer’s CEO explained that American companies are “resetting their supply chains” with a focus on bringing goods closer to end users. Between the pandemic, port issues, and now the geopolitical mess in Europe, the case for having shorter supply lines looks better than ever.

Some folks are terming this deglobalization, as North American manufacturers pull out of China, Vietnam and other far-flung countries.

However, I’d term it something more like regionalization. The recent enhancements to the NAFTA (now USMCA) free trade pact make US/Canada/Mexico a powerful and close to permanent trade block. Regardless of what president is in power in either the U.S. or Mexico, it’d be near impossible to unwind the trade agreement at this point.

And given it, manufacturers are very happy to rely on Mexico for the nuts and bolts stages of the manufacturing process, while doing the higher-value add finishing touches in the U.S. or Canada. In a world where it becomes economically or politically unfeasible to manufacture in China, that stuff has to come back to North America. But most manufacturing isn’t competitive at $35/hr wages in the U.S. or Canada. Almost by process of elimination, these jobs have to end up in Tijuana, Reynosa, Juarez, Monterrey, and other such Northern Mexican cities.

The data from that WSJ article reflect that:

The added suppliers tend to be closer to the buyer and its customers, [Jaggaer’s CEO] said. The company tracked a 514% increase from 2020 to 2021 in Mexican suppliers receiving bids from its big U.S. buyers and a 155% increase in Latin American suppliers receiving bids over the same period.

At the same time, the company found those manufacturers sought goods from 26% fewer suppliers in the Asia-Pacific region.

This is a massive development for the bullish thesis on Mexican companies with heavy exposure to manufacturing in that country. We’re seeing a massive swing, in real-time, toward near-shoring (manufacturing in cheaper countries just outside the U.S.) It’s not hypothetical anymore; just one year into the economic reopening following the pandemic, Mexico’s suppliers have already entered a golden age.

This reliance on multiple suppliers is also great news. Even if the ultimate amount of goods may be the same, spreading business across three or four different Mexican companies per order instead of one creates far more resiliency and economic roots than relying on one monopoly-style supplier in Mexico.

The more small and medium-sized manufacturing enterprises that Mexico can support, the healthier the economy will be. A thriving economy across Northern Mexico with tons of strong employers will create an unprecedented wave of economic activity in that region, with numerous investing consequences.

My Favorite Mexican Play: Centro Norte

It’d be tempting to just buy the iShares MSCI Mexico ETF (EWW) to get exposure to these themes. However, many of its top holdings don’t have much particular exposure to manufacturing growth, so I think there are better specific options.

My favorite way to get exposure to Mexican manufacturing is through airport operator Grupo Aeroportuario del Centro Norte (NASDAQ:OMAB). I’ve been covering this company for six years now, so I won’t do another deep dive on it today, I’d refer you back to my past work:

Ian Bezek’s articles about OMAB stock (Seeking Alpha)

That said, I’ll give you a quick overview on why Centro Norte is uniquely positioned to benefit from Mexican manufacturing. It starts with the geography of the airports they operate. There are three publicly-traded Mexican airport companies, after all, but Centro Norte has the most torque to this thesis.

Here’s Centro Norte’s map of airports that they operate:

OMAB’s airport holdings (Corporate Twitter account)

As you can see, Centro Norte operates the airports of Juarez and Reynosa, both of which are right on the Texas/Mexico border. Additional airports such as Torreon and Chihuahua are in industrial regions near the border.

And then there’s the company’s crown jewel, Monterrey, which is the crossroads for Mexican heavy industry. Key domestic players such as cement company Cemex (CX) are headquartered in the Monterrey metropolitan area. Additionally, Monterrey has become a hub for numerous North American manufacturing companies in industries such as autos, aerospace, HVAC, and medical devices. Estimates suggest that more than one-quarter of all Mexican manufacturing occurs in Monterrey.

Major rail lines from Texas and the Midwest run to Monterrey and then split off from there to points further south along with both coasts.

As I highlighted previously, the Kansas City Southern railroad (which operates the key lines in Monterrey) ended up in a massive bidding war in 2020 as shrewd investors rushed to buy up Mexican manufacturing related assets even as the pandemic was still near its worst. Even then, it was already becoming clear that Mexico was going to be a massive beneficiary of the global economic realignment that was on the way.

Less than two years later, Mexican suppliers are doing record numbers, meanwhile North American buyers are distancing themselves from Asian suppliers. That’s fantastic news for Monterrey and the Kansas City Southern Rail. Sadly, that railroad is no longer an independent company. However, Centro Norte, which operates Monterrey’s airport, is the next best thing.

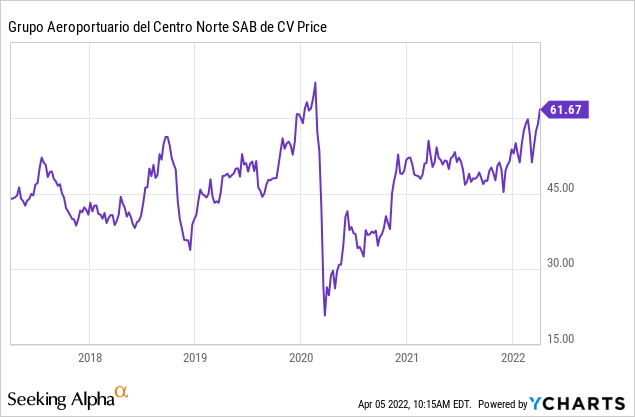

OMAB shares have moved back to near pre-Covid highs. And it exceeds them on a total return basis once you add back the $6.28 per share of dividends that the company has paid out over the past 12 months.

That said, there should be significantly more upside ahead. OMAB was only trading around its normal historical median EV/EBITDA ratio in January 2020, as EBITDA had been growing more quickly than the firm’s stock price for quite a while. With Centro Norte’s traffic set to surpass 2019 levels in 2022 and with profit margins up, this should be a record year of profitability for the company. Throw in the fact that Centro Norte’s region of the country is absolutely booming right now, and there’s an obvious case for multiple expansion going forward.

Another clear winner is rival airport group Pacifico (PAC). Pacifico operates a more mixed basket of airports, including the huge city of Guadalajara, the industrial powerhouses of Tijuana and Hermosillo, and tourist attractions such as Puerto Vallarta and Cabos.

Pacifico’s traffic bounced back faster than Centro Norte’s because Puerto Vallarta and in particular Cabos saw traffic rocket higher thanks to Mexico’s relatively lax Covid-19 restrictions. Mexican tourism has already overtaken 2019 levels, leading to a rapid recovery in Pacifico’s overall picture, leading its stock to jump to new all-time highs already.

Pacifico will benefit from increasing industrial activity in places such as Tijuana, however it will be blended with tourism as well, whereas Centro Norte is more of a pureplay on Mexican industrial cities.

Other Mexican Companies To Watch

Aside from the airports, what else benefits from more manufacturing and thus more high-quality jobs in Northern Mexico?

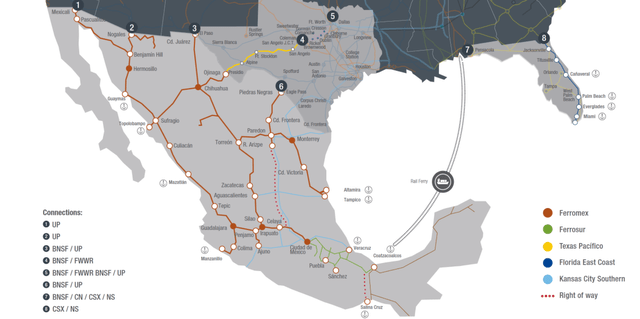

The most obvious is arguably Grupo Mexico Transportes (MEXICO-GMXT) which controls the FerroMex railroad along with several smaller lines:

Grupo Mexico Transportes Route Map (Corporate Website)

Kansas City Southern’s lines were more ideally located. It’s hard to beat that straight shot up from Mexico City through key industrial cities like Queretaro, San Luis Potosi and Monterrey directly on to Central Texas. That said, Grupo Mexico has some interesting assets in its own right, with two major north-south routes in Mexico. It’s hard to see a scenario where this rail network doesn’t pick up more traffic as manufacturing booms.

Switching gears, consumer staples companies should see an uptick in results. Something like Coca-Cola Femsa (KOF), the country’s leading soda bottler, probably enjoys improving margins as Mexican consumers are more flush with cash. KOF stock went up fourfold coming out of the financial crisis as the Mexican economy roared back to life. Since 2013, however, it has been dead money as the Mexican economy decelerated. Small marginal improvements in economic activity can make a big difference for this sort of firm.

Its corporate parent, Femsa (FMX) is also interesting. Femsa operates more than 15,000 OXXO convenience stores across Mexico, along with smaller businesses in gas stations, pharmacies, and various other things.

OXXO is fascinating since it is a leader in payments, money transfers, remittances, and banking services for the unbanked. As Mexican laborers move from the south to the industrial north for the new high-paying factory jobs, they will utilize OXXO services to send money back to their families along with paying bills and so on. OXXO’s push into digital wallets should help further broaden this line of business.

Mexico has started to develop a more robust REIT sector, so there may be some deals there, particularly in assets such as warehouses and logistics. I haven’t done the work there myself though, so that’d be something for readers to potentially look into.

One other popular play on the improving Mexican economy is in its homebuilders. This is logical in theory, as there has been a shortage of new homes built in that country over the past decade. On top of that, there are favorable demographics to drive an uptick in housing demand.

I am currently not involved in the sector, however, as I’m not convinced the current publicly-listed homebuilders are the best ways to bet this trend. One prominent one, for example, owns a ton of land in Cancun and other tourist destinations.

These sites will not benefit from Mexican manufacturing in any meaningful way, rather that’s more of a play on wealthy Canadian or American retirees buying a beach house. That’s a fine idea, but don’t mix it up with homebuilders constructing tons of starter homes in Monterrey and other northern industrial cities.

On a related note, I do like Grupo Rotoplas (OTCPK:GRPRF) (Mexico-AGUA) which sells a wide assortment of water pipes, tanks, filters, treatment systems and so on.

Rotoplas products (Corporate website)

Access to clean water is a pressing concern in Mexico, and it’s particularly a problem in newly-built suburbs and outlying areas.

Much of the country still relies on trucks to deliver water directly to people’s houses and businesses. This is terrible for the environment, and it’s also now terrible economics given the soaring price of diesel. Rotoplas should have a huge market opportunity to install water infrastructure in Mexico in the 2020s, and on top of that, it is also levered to the Mexican housing market.

[ad_2]

Source link

/cloudfront-us-east-2.images.arcpublishing.com/reuters/M4O2GCFNPNJNRAFOME2WYD3OAA.jpg)