[ad_1]

intermediate

Bitcoin, Bitcoin… Is there anything new to say about this cryptocurrency at this point? Even people who have zero interest in the industry have heard its name. As the number one cryptocurrency, it enjoys unimaginably high prices (up to $60K), a lot of attention, and, of course, much scrutiny.

Bitcoin, alongside the rest of the crypto market, is known for its ability to overcome any challenges and have strong comebacks despite everyone writing it off. Various financial experts have been predicting that the Bitcoin bubble will pop “in the near future” every month without fail for the past eight or so years. And yet, the coin still remains on top, and BTC investors enjoy high profits.

However, the crypto industry is rapidly changing, and some crypto enthusiasts are starting to doubt whether Bitcoin is still worth investing in.

Please note that this is our long-term Bitcoin price forecast. This article does not constitute financial advice, and we are not investment advisors.

What Is Bitcoin (BTC)?

Bitcoin is a proof-of-work based blockchain and the first cryptocurrency that was created back in 2009. It is a decentralized digital currency that uses blockchain technology to facilitate trustless peer-to-peer transactions.

In recent years, Bitcoin has been one of the most popular assets for investment: not only can it be extremely profitable due to the high volatility of the crypto market, but it is also very easy to invest in. All one needs to get Bitcoin is an Internet connection.

What Affects the Value of Bitcoin?

There are a lot of different factors that can affect the price of Bitcoin. Unlike most altcoins, it does not depend as heavily on the rest of the crypto market and usually ends up being the one to set the trend. However, BTC is still responsive to huge crypto news, especially ones that either concern the industry as a whole or other big coins like Ethereum or Shiba Inu. Bitcoin’s price also gets affected by non-crypto news — a great example of that would be its price action in the spring of 2020. Another news sector that those who invested in Bitcoin or are planning to do so should look out for is ecology.

Just like any other asset, Bitcoin gets affected by news related to it, be it about Bitcoin itself, crypto exchanges, or blockchain technology. Crypto prices usually go up when there is a piece of news related to mass adoption, new technological breakthroughs, and so on. On the other hand, any uncertainty can cause its value to plummet.

Bitcoin Price Analysis

On the surface, the crypto market is only ever-developing: more and more businesses are introducing crypto-related products and services (fashion brand Fendi releasing a crypto wallet in collaboration with Ledger, Twitter introducing NFT profile pics). Yet, many experts are starting to question the technology’s long-term viability. While significant public pushback against the new technologies can be explained away as fear and misunderstanding of something new, increasingly harsh regulations all around the world are making many experts wary of investing in crypto.

Unlike Ethereum or Solana, Bitcoin doesn’t have the benefit of being a sprawling ecosystem of highly varied crypto products and services. It is what it claims to be — Bitcoin is a digital currency, nothing more, nothing less. Coupled with its slow reaction to change and non-eco-friendly proof-of-work (PoW) consensus algorithm, Bitcoin is starting to seem less and less like a lucrative investment.

Additionally, we’re currently in the middle of a bear market, and the crypto space isn’t exactly known for making rational investment decisions. There are a lot of holders with so-called “weak hands” who sell off all their crypto funds at the first sign of trouble, which adds tension to the market.

Can Bitcoin recover from all this and retake its previous highs? Well, it definitely has done it in the past. Of course, only time will tell how well BTC will do in the future, but we believe that its price still has a chance to soar.

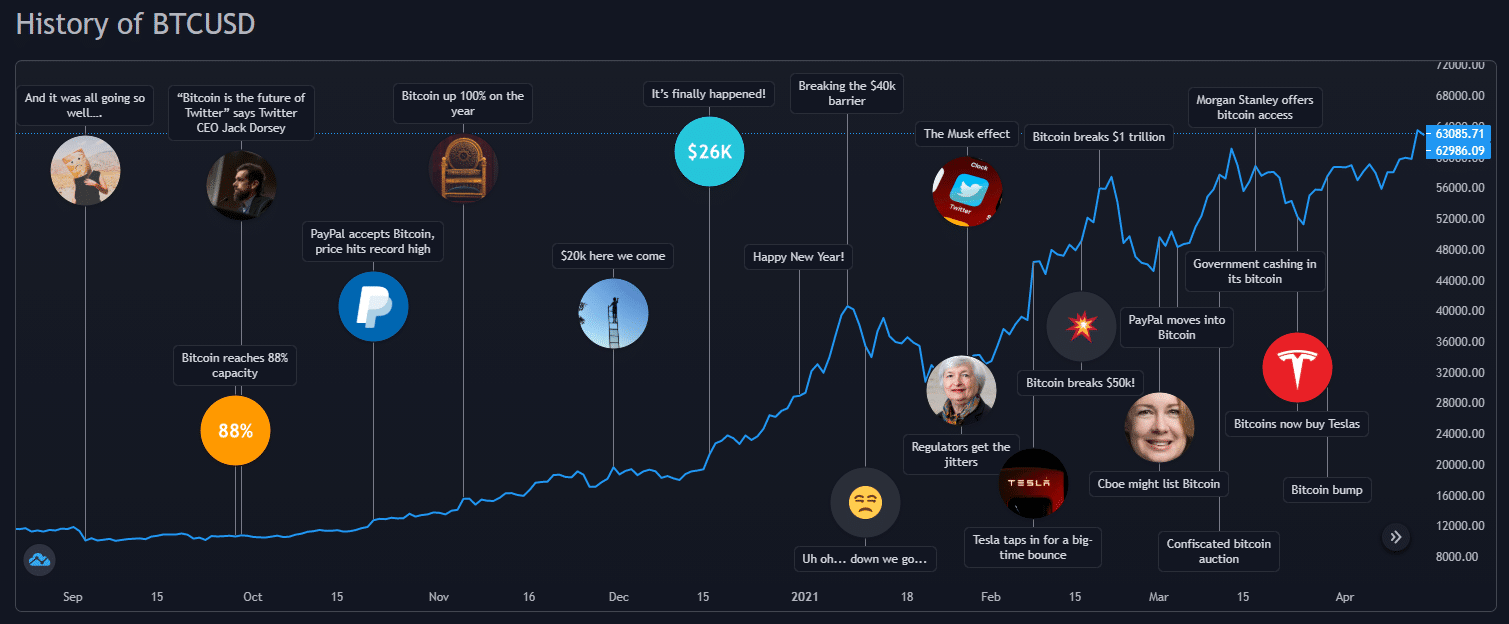

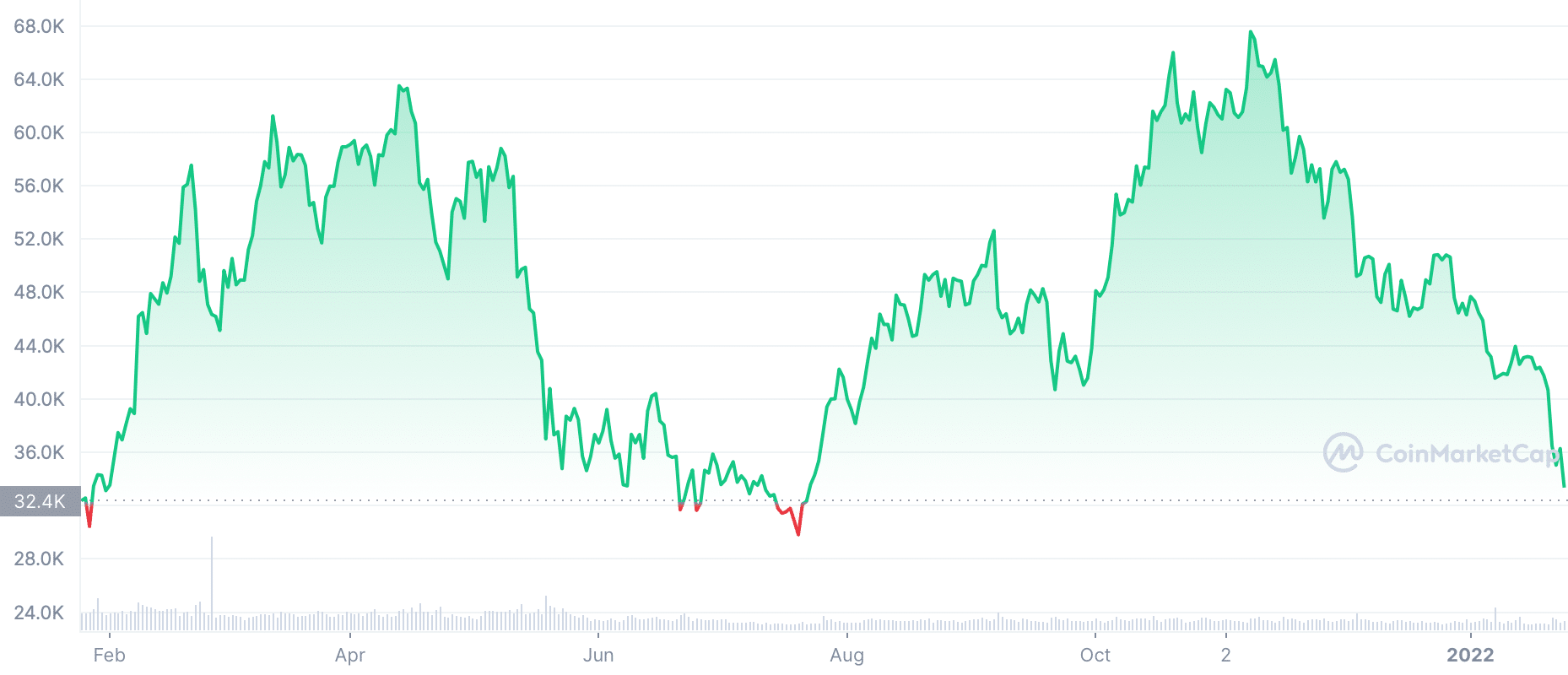

Now, let’s take a brief look at Bitcoin’s price history.

One thing that becomes immediately apparent upon looking at this chart is that Bitcoin’s price cycles keep on shortening. Additionally, despite the coin regularly losing value, the average value of Bitcoin keeps increasing. This shows a positive trend for the future.

Bitcoin Price Today

Bitcoin Price Predictions for 2022 by Experts

Due to Bitcoin’s popularity, its price is analyzed by a much larger number of industry experts than any other cryptocurrency’s price. Even people from outside the crypto space discuss it.

Wallet Investor

Most analysts are bullish on Bitcoin, and Wallet Investor is no exception. Their data shows that the coin is likely to hit $72K a year from now, and their 5-year forecast predicts that BTC will get close to $200,000. They’re forecasting an almost 400% ROI for Bitcoin by 2027.

Gov Capital

Gov Capital’s prediction on Bitcoin’s future prices is extremely optimistic. Their analysts are expecting the coin to triple in value, reaching over $120K by the beginning of 2025. That’s not all: they’re predicting further growth for BTC later that year, with the cryptocurrency hitting $185,000 before the start of 2026.

Trading Beasts

However, not everyone is bullish on Bitcoin. Trading Beasts expects the coin to stay in the $40K range for the entire 2022, and their data shows that the cryptocurrency may even dip down to $30K by the end of 2023. That said, their long-term price forecast for BTC is still fairly optimistic: they can see the coin hitting a new all-time high of $80K in 2025.

Digital Coin Price

Digital Coin Price expects Bitcoin to bounce back into the $60K price range sometime in 2022, and their experts think that $100K is a possibility in the near future.

Other Crypto Investors & Experts

YouTuber Mango Research is also bullish on Bitcoin in the long run. Their technical analysis shows that the coin will plunge to as low as $20K before it bounces back to $60,000.

Trading View’s current signal for Bitcoin is a “Strong Sell,” indicating that their technical analysis predicts a further price decline for BTC in the short run. However, many experts on the website believe that the cryptocurrency will be able to bounce back soon.

Bitcoin (BTC) Price Prediction for 2022-2040

| 2022 | $40,000 |

| 2023 | $45,000 |

| 2024 | $70,000 |

| 2025 | $85,000 |

| 2026 | $70,000 |

| 2030 | $100,000 |

Bitcoin Price Prediction 2022

We are bearish on Bitcoin in the short run. The current bear market and the lack of any favorable crypto news will likely stop Bitcoin from retaking its previous highs in the near future.

We expect the cost of BTC to keep going down in the first quarter of 2022, perhaps even reaching its 2-year minimum of $30K. With the stock market also suffering losses around the globe, both the markets and the investors seem very hesitant at the moment. Lack of stability in the East, especially in Kazakhstan and Russia, and some existing and potential regulatory changes have also had an impact on the value of the cryptocurrency.

The current state of the global economy is definitely not the same as it used to be at the beginning of the pandemic, and it is unlikely that we will see anything similar to what the US Federal Reserve did back then. As a result, we do not think that the market will experience a repeat of the 2020-2021 crypto boom in 2022.

We predict that Bitcoin will mostly stay at the same price level throughout the year and then go back to the $40K price level by the beginning of next year.

BTC February 2022

We expect the bear market to continue in February. All the technical indicators are pointing toward Bitcoin’s current price not being its minimum limit, so the cryptocurrency is likely to drop further.

BTC March 2022

The price of Bitcoin is likely to stay in the $30K range throughout March 2022 unless there is some unexpected news that will either tank its price or shoot it to the moon. At the moment, we think the former is more likely. That said, the constant decline of Bitcoin’s price may raise the demand for the coin and prompt it to shoot back up into the $40K range — though currently, we expect that to happen a bit later this year.

Bitcoin Price Prediction 2023

We believe that Bitcoin’s average, maximum, and minimum prices in 2023 will all be rather tame. The first quarter of 2023 will likely see the BTC price staying at the $30K level.

Our data shows that Bitcoin is likely to start rising sometime in mid-2023 and go as high as $45K by December of next year.

Bitcoin Price Prediction 2024

2024 will be a very important year for Bitcoin: that’s when the cryptocurrency’s next halving will take place. As a result, we expect the asset’s price to rise dramatically by the end of the year, averaging around $70K.

Bitcoin Price Prediction 2025

The bull market kick-started by the halving is likely to continue in 2025, gaining traction as months go by. We predict that the demand for Bitcoin will rise, and with it, the coin’s price will go as high as $80K.

Bitcoin Price Prediction 2026

Bitcoin is likely to drop by a few levels in 2026, following its rally in 2025. We predict that its price may stay at the $70K mark for the majority of 2026.

Bitcoin Price Prediction 2030

There are various Bitcoin price projections for 2030 that seem completely crazy as they claim that the coin will reach $300K or won’t be able to break past $20K or will stay at $50K. Our prediction is comparatively conservative: we expect the BTC price to average out at around $100K by 2030. We believe that it will have higher peaks (and lower lows) than that, but we see $100K becoming the cryptocurrency’s new medium, the same way we see $30K now.

Bitcoin Price Prediction 2040

What will Bitcoin be worth by 2040? Well, who knows. It can rise tenfold and reach the $400K mark, or it can drop down to $1 and fade into obscurity under the weight of strict government regulations. The former seems much more likely at the moment, but there’s really no way to tell.

If you plan on holding Bitcoin that far into the future, then you are most likely one of the devout proponents of crypto and blockchain technology. In that case, we would recommend not concerning yourself with the coin’s future price and just continuing to amass your BTC funds little by little.

Is Bitcoin a Good Investment?

Bitcoin is currently in a downtrend and is predicted to rise in the future. So, it can be a good investment. However, please DYOR and carefully consider the risks before investing in BTC or any other cryptocurrency.

Our Bitcoin price prediction is rather conservative and does not take into account any random media hype or unexpected regulations that may happen in the near future — these factors are too unpredictable. However, if you’re considering investing in Bitcoin, you need to make sure you’re ready for its price to fluctuate wildly.

Bitcoin is less risky than other cryptocurrencies, but it is still fairly unstable and unpredictable in comparison to traditional investment avenues like the stock market.

Bitcoin vs Fiat Currencies

Compared to cryptocurrencies, fiat currencies are comparatively low-risk assets, especially ones like the US dollar. However, they can still definitely be risky.

Institutional investors have tentatively started putting their trust in Bitcoin and other cryptocurrencies. Nevertheless, digital assets definitely do not have the same relevancy as fiat money like the euro or the US dollar — at least, not yet.

Bitcoin is a higher risk, higher reward investment alternative to fiat money that gains additional value if you believe in its worth as a currency of the future.

FAQ

How much will Bitcoin be worth in 2025?

We think that Bitcoin might cost $85,000 in 2025.

What will Bitcoin be worth in 2022?

Bitcoin’s average price will likely be around $40K-$70K in 2022.

What is the next big cryptocurrency in 2022?

Solana, SHIB, Ethereum, and some other altcoins have the potential to hit it big in 2022.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

[ad_2]

Source link