[ad_1]

Are you thinking about buying Penny Stocks? Most speculative investors will be buying into an investment which are pennies for each share and then wait until it peaks before selling for a rewarding profit. Inspired by reports of individuals who profited with this stock trading technique, these individuals will be lured into penny stocks investment. These type of stocks are also known as micro cap equity.

Penny stocks are usually lower priced stocks which trade off leading exchanges on the Pink Sheets and Over the Counter Bulletin Board (OTCBB). The SEC or Securities and Exchange Commission looks at any kind of stock trading below $5 as a penny stock. Generally, the benefits of purchasing mico cap will be speculative in nature although many of them tend to be well-managed organizations which have a good chance of future growth.

All stocks on OTCBB will be instructed to file well-timed financial statements with the SEC. As a result, it will be easy to perform through a financial analysis for the reason that many any other organization listed on the major exchanges. However, there are many factors which makes buying these low-priced stocks a very risky investment other than just maintaining accessible financial statements.

Businesses buying and selling on the Pink Sheets will not be instructed to file fiscal reports with the SEC. As of such, it could be challenging or almost impossible on occasion to carry out an in depth financial analysis. Most of these businesses will lack the reputation of a consistent good performance or might not have any form of past records. This is often because of issues like: being recently formed or even poor management which results in serious financial difficulties.

Buying the lower priced stocks on the Pink Sheets and OTCBB may potentially be opening doors to brokers who exhibits fraudulent or questionable behavior. The original public offering of penny stocks might be as a result of initiatives made by fast talking brokers who might be trying to acquire the most money possible from any interested investor. Additionally, a company might be close to ineffective and is getting dumped on the general public by the proprietors.

These days the internet is filled with mass newsletters, message boards and emails from companies and brokers attempting to allow persons to take part in “hot stock” secrets. These are generally micro cap which might be on the brink of infamy and the brokers are prepared to withdraw as the first opportunity present itself. Keep in mind that these are only a few of the reasons why a trader needs to be careful when it comes to including such stocks within their stock trading system.

Penny stock firms can differ significantly from quite noticeably organized businesses to more freely organized one man businesses. As an investor it is always advisable to do some investigative research to obtain enough information and assurance prior to buying penny stocks.

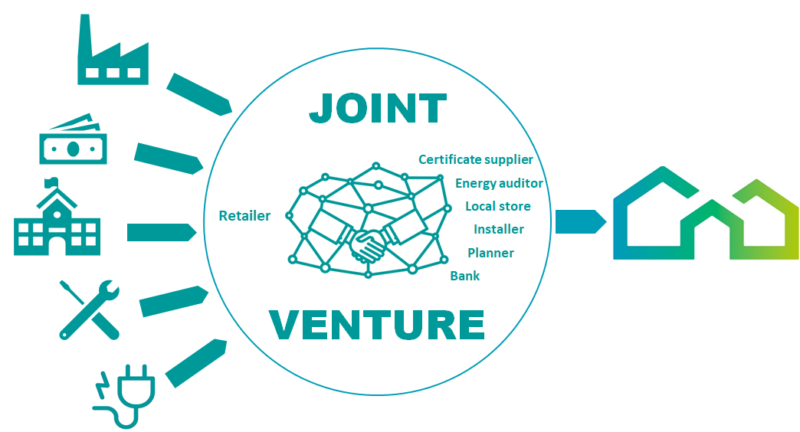

/JointVenture_397540_final_2-1eee631af3444e9ea3019ebbb6c890e9.png)