[ad_1]

MEXICO CITY, May 11 (Reuters) – Grupo Mexico (GMEXICOB.MX) is planning $3.1 billion in new investments for metals refining in Sonora state and power infrastructure for a major mine that will bring cheaper electricity to the isolated Baja peninsula, the company’s No. 2 executive told Reuters.

The six-year investment blueprint includes a $2.3 billion expansion to existing smelting capacity in Sonora, a northern state home to the company’s top mines, and $815 million for major new electricity lines for the Baja California peninsula.

Grupo Mexico Vice Chairman Xavier Garcia de Quevedo detailed nearly $9 billion in investments through 2027, including a previously-announced $2.8 billion for its proposed El Arco copper mine, which would anchor the Baja power investment. The rest will be spread over additional infrastructure, two other mines and new zinc refining capacity.

Register now for FREE unlimited access to Reuters.com

Garcia de Quevedo, who has spent five decades at the company controlled by Mexico’s second-richest man, minimized suggestions that political risk could derail the company’s investment plans.

While the two-year-old administration of leftist President Andres Manuel Lopez Obrador has shown mixed support for mining, Garcia de Quevedo said the mining, rail and energy company’s plans have been discussed with senior government officials.

“This is something that the government knows very well,” he said in an interview last week, noting the projects require permits but no new mining concessions. “We all trust that we could have all the authorizations very soon.”

The energy plans in Baja would benefit El Arco as well as domestic and commercial power users in a region that includes the Los Cabos tourist hub, he said.

“Baja California’s huge potential can’t be developed without electricity,” said Garcia de Quevedo, pointing to power rates he said are around three times higher than the national average.

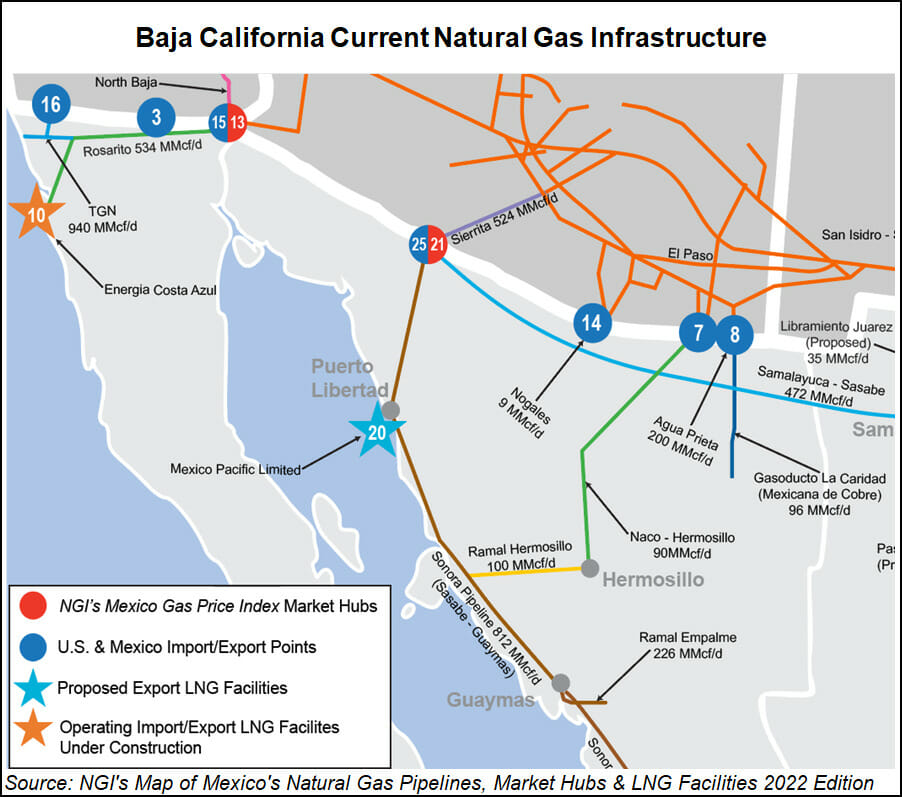

The proposed power infrastructure includes a 500-km (310-mile) transmission line running north-south along the southern half of the peninsula. He declined to specify where the power would originate.

Lopez Obrador deemed mining an essential sector last year amid a wave of pandemic-related business restrictions, but has been widely criticized by the industry for the slow pace of permits and approvals, attributed to spending cuts at his environment ministry, as well as a policy of no new concessions.

The president’s office did not immediately respond to a request for comment about the permitting process, the spending cuts and the policy on concessions.

Grupo Mexico, the country’s third-largest company by market capitalization, has mining operations across the Americas via its majority-owned Southern Copper Corp (SCCO.N). It also has a major rail freight business in Mexico and a big presence in the country’s oil sector, transporting refined products for state-run energy company Pemex (PEMX.UL) by both rail and pipeline.

COPPER RALLY

The world’s fifth-biggest copper producer, Grupo Mexico’s overall copper output is expected to dip this year by up to 1.5%, on lower output from Peru, Garcia de Quevedo said.

However, he said, new copper production was set to come online from key mines by the second quarter of 2023, including an additional 36,000 tonnes a year from its El Pilar mine in Sonora and 30,000 tonnes annually from Buenavista.

El Arco, further out, is due to produce 190,000 tonnes annually from 2027. The timing of the closer mines comes as copper prices have begun to soar and are forecast to go higher.

“We’ve always followed the philosophy of planning our investments on (the expectation) of low copper prices,” Garcia de Quevedo said, noting Grupo Mexico typically plans for copper at about $5,500 per tonne, far below a recent all-time high over $10,700.

Benchmark copper on the London Metal Exchange was holding above $10,400 a tonne on Tuesday.

Goldman Sachs has forecast that copper prices will likely keep climbing, averaging $9,675 a tonne this year, $11,875 in 2022 and $12,000 in 2023.

Grupo Mexico – owned by billionaire German Larrea, who criticized Lopez Obrador just months before his 2018 victory – won a contract along with Spain’s Acciona to build a stretch of the Maya Train tourist rail project, a top priority of the president that will connect beach resorts Cancun and Tulum.

“What we want is to be an ally of the government,” Garcia de Quevedo said.

Elsewhere, Grupo Mexico is still awaiting a construction license for its Tia Maria copper project in Peru and the mine’s fate will likely depend on the winner of next month’s presidential vote, he said.

The company’s shares recently rose on polls showing Keiko Fujimori, the business-friendly right-wing candidate, closing the gap with socialist rival Pedro Castillo, who has pledged to renegotiate mining contracts.

Register now for FREE unlimited access to Reuters.com

Reporting by David Alire Garcia; Editing by Amran Abocar, Tom Hogue and Marguerita Choy

Our Standards: The Thomson Reuters Trust Principles.

[ad_2]

Source link